Table of Content

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Also make sure the quotes highlight the amounts of the discounts you will receive for bundling. Plus, you have the added benefit of only having to deal with one company for the claim, rather than two separate companies with different processes. She is truly passionate about helping readers make well-informed decisions for their wallets, whether the goal is to find the right comprehensive auto policy or the best life insurance policy for their needs. The average cost of homeowners insurance nationwide is $2,777 a year for $300,000 in dwelling coverage. Your insurance rate will vary based on where you live and factors specific to your home.

Bankrate

We know that it can be stressful to navigate the insurance coverage process, but we strive to make it as smooth as possible. Starting a business and want some information on commercial insurance options? At Freeway Insurance, we have a wide variety of insurance solutions designed to give you peace of mind.

Nationwide has more than 11,000 independent agents who can help you choose the right coverage options with the best savings possible. However, if you live in Florida, Louisiana, Massachusetts, New Jersey or New Mexico, you may not have access to either Nationwide home or auto insurance. Before making your purchase decision, keep in mind that Nationwide scored below the industry average in J.D. Home Insurance Study for customer satisfaction, showing that some policyholders may not have been satisfied with their experience. However, Nationwide has an A+ financial strength rating from AM Best. Nationwide offers diverse coverage options for homes, condos and apartments, farms, pets, vehicles, investment products and much more.

Cheapest home insurance companies by credit tier

Contact your agent to review your policy and ensure you're taking advantage of all the discounts available to you. Your current insurer may allow you to bundle policies, but that doesn’t automatically mean you’re getting the best rates available. Additionally, bundling home and auto policies may hamper you from shopping around, since you may want to find a new carrier that allows you to insure both products at the best price with the best discounts. A car insurance company may have a partner company that sells home insurance and call it a “bundled” policy. While having the two policies could still generate significant savings, holding separate policies with different insurers means you won’t be able to manage your policies all in one place.

Here’s a few steps you can take to lower your existing rates and get cheaper home insurance. If switching to a new carrier, make sure you cancel your old policies on the day your new policies are set to start so you avoid an overlap or lapse in coverage. If we give you the option to remove cover for flood, rainwater run-off and storm surge and you choose to do so, you won’t be covered for loss or damage to your home caused by flood, rainwater run-off or storm surge. We only provide cover for the contents that are owned by the people that are listed on the policy. The amount you want to insure for should represent those items.

How to claim your pension

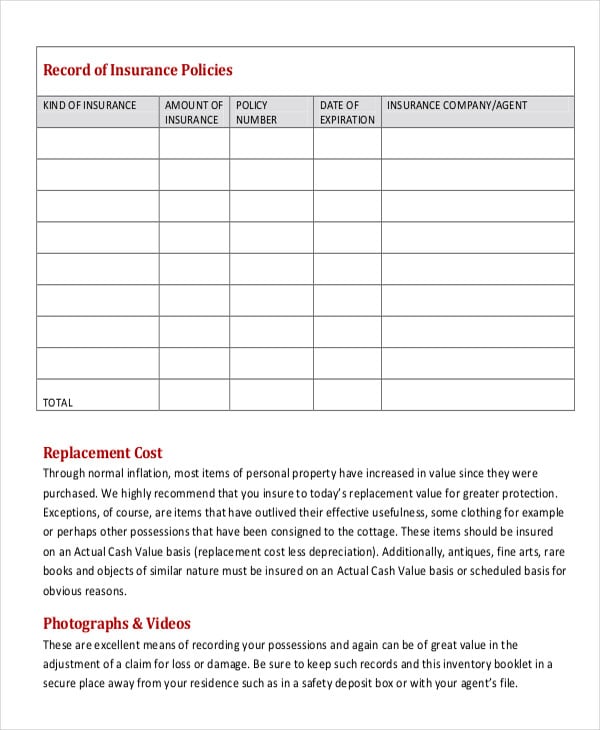

However, taking a full inventory of your possessions is the best way to determine how much property coverage you need. Be sure you also compare replacement cost vs. actual cash value coverage, as these provide significantly different amounts of coverage. Start with your insurance company to see whether it offers an inventory app or recommends one. Your ERIE agent can help you with your coverage and identify high-value items that need extra protection on your policy.

To compensate for the increased risk, carriers may charge you more for coverage for a period of three to five years after a loss in the form of a premium surcharge. Before filing, you might want to get an estimate for the damages; knowing when and how to file a home insurance claim could help you decide if it’s the right move. Damages that are not significantly above your deductible might be better handled out of pocket. Paying for smaller damages out of pocket can help you keep affordable insurance premiums. If you have suffered a significant loss, though, filing a claim with your insurer is typically your best option. You carry homeowners insurance to protect yourself against financial devastation.

Review of the Motor Vehicle Insurance and Repair Industry Code of Conduct

Understanding what you are looking for from a home insurer and obtaining multiple quotes can be helpful. If you already had home and auto insurance coverage with other carriers, you will need to cancel your existing policies if you plan on placing them with a single insurer. When switching to a new carrier, it is typically best to wait to cancel your prior policies until you know the effective date of the new policies, so you can avoid a lapse in coverage. We determined the following companies to be the best companies for home and auto insurance bundles.

The company also has a network of more than 12,000 exclusive local agents that can help answer your policy questions and assist you in setting up home and auto bundling. Allstate’s average premiums are on the high side, but with bundling and other possible discounts available, you may find your rates dropping below the average. Your premium may increase at your policy renewal after filing a home insurance claim. This is because once you have filed a claim, insurance companies might view you as more likely to file additional claims.

However, home insurance is typically paid through your mortgage lender via an escrow account — not paid directly by the policyholder. Car insurance discounts for bundling typically offer significant savings on your home and auto policies. Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. A good car insurance policy makes sure your vehicle stays safe and secure against any unfortunate event and your expenses completely covered in the wa... With just a few easy steps you can compare rates from the top insurance companies and choose the best coverage for your needs.

While most insurance experts agree that purchasing home insurance is a good idea, you don’t have to overpay for coverage. You can take steps to find the most affordable home insurance policy that fits your needs and provides you with financial peace of mind. Multi-policy discounts are usually some of the biggest discounts a company offers and can save you a significant amount of money. However, that doesn’t mean that it’s the best option for you. Shop around and work with a licensed insurance agent if you aren’t sure if a policy bundle fits your needs.

Progressive offers numerous products that could help you bundle more than just your home and auto coverage, making it easier to manage your insurance and save money. It can be helpful to shop for insurance after significant events in your life that tend to alter your finances, like getting married or divorced, having a baby or moving to a new home. Determining if you are looking for exceptional customer service, a highly rated mobile app or certain coverages, for example, can help you decide which companies to get quotes from.

For homeowners looking to consolidate their insurance and financial products with one company, Nationwide might be a good choice. Nationwide is not the cheapest homeowners insurance company on our list, but its average premium is still well below the national average. Additionally, the insurer offers several discounts that could help you lower your rate. Nationwide holds an A+ financial strength rating from AM Best.

It may also be beneficial to work with a local insurance professional who can provide you with guidance throughout this process. Whether you’re shopping for your first car insurance policy or coverage for your vacation home, you need trusted expert advice to get the right insurance. We’ve got all of the expert guidance, up-to-date coverage and rate details, and money-saving tips you need to shop for insurance with confidence. Your doctor or other health care provider may recommend you get services more often than Medicare covers. If this happens, you may have to pay some or all of the costs. Ask questions so you understand why your doctor is recommending certain services and if, or how much, Medicare will pay for them.

Log in to the Pension Portal or use our pension calculators and tools to estimate how much pension will get. See the different options available to increase the amount of Civil Service pension you will receive when you retire. Whether you're planning to retire or thinking about your pension, get information to help you plan for your future. Along with your salary, your pension is one of the most important benefits of joining the Civil Service. The insurer will allow hospitals to check members' eligibility so members are able to give informed financial consent when they are admitted to hospital for medical treatment.

No comments:

Post a Comment